Buying real estate in British Columbia isn’t for the faint of heart. It can be a cut throat journey full of a lot of unexpected costs. We want to make sure you’re able to get the most out of your purchase and keep as much money in your pockets as possible. There are a number of government programs designed to ease the financial burden but they can be hard to find, understand and know if you’re eligible. In this guide, we’ll explore various grants and incentives to ensure you’re able to get all of that juicy information right into the palm of your hand, making the journey to homeownership smoother and more affordable.

1. First Time Home Buyers’ Program: Opening Doors for New Homeowners

The First Time Home Buyers’ Program is a game-changer, reducing or even eliminating property transfer taxes for first-time buyers. If you qualify, you may enjoy a full or partial exemption based on your circumstances. The key qualifications include being a Canadian citizen or permanent resident, having never owned a principal residence, and meeting specific property criteria.

Tip: Even if you share the property with others, only the qualifying buyer(s) benefit from the exemption.

2. Newly Built Home Exemption: A Fresh Start for New Homeowners

If you’re eyeing a newly built home, the Newly Built Home Exemption is here to help. This program offers a reduction or elimination of property transfer taxes for eligible buyers. The property must be your principal residence, have a fair market value of $750,000 or less, and meet specific size criteria.

Tip: If you paid taxes for vacant land and built a home, you might qualify for a refund.

3. About the Home Owner Grant: Making Homeownership More Accessible

Most property owners can qualify for the regular grant, with additional grants available for seniors, veterans, and those with disabilities. The grant amount varies by region but can significantly reduce your property tax burden.

Tip: Ensure you meet the criteria and pay the minimum property taxes to claim your grant.

https://www2.gov.bc.ca/gov/content/taxes/property-taxes/annual-property-tax/home-owner-grant

4. Property Tax Deferment Program: Easing the Financial Load

Unable to pay property taxes? The Property Tax Deferment Program offers relief through the Regular Program, catering to individuals aged 55 or older, surviving spouses, or persons with disabilities. It’s a lifeline for those facing financial constraints.

Tip: Ensure your property meets equity requirements and consult your lender about potential conflicts.

https://www2.gov.bc.ca/gov/content/taxes/property-taxes/annual-property-tax/defer-taxes

5. The First-Time Home Buyer Incentive: Sharing the Load with the Government

This shared-equity mortgage program by the Government of Canada is a boon for first-time buyers. It reduces monthly mortgage payments by offering a 5% or 10% incentive for newly constructed homes or 5% for resale properties.

Tip: Repayment is required after 25 years or when selling the property.

https://www.cmhc-schl.gc.ca/consumers/home-buying/first-time-home-buyer-incentive

6. Home Buyers’ Plan: Tapping into Your RRSPs for Homeownership

The Home Buyers’ Plan allows you to withdraw up to $35,000 from your RRSPs to purchase or build a qualifying home. It’s a strategic move to leverage your savings for homeownership.

Tip: Plan your withdrawal wisely to maximize benefits.

7. GST/HST New Housing Rebate: A Refund for New Home Buyers

New home buyers can apply for a rebate on the GST, with varying percentages based on the purchase price. It’s a valuable incentive to offset costs for homes priced at $350,000 or less.

Tip: Check the proportional rebate for homes between $350,000 and $450,000.

8. First Time Home Buyers Tax Credit (HBTC): A Tax Break for New Homeowners

Eligible individuals who bought a qualifying home in 2023 can claim a home buyers’ amount of $10,000. It’s a non-refundable tax credit offering financial relief for homeowners.

Tip: Claim the credit when filing your income tax returns.

9. Home Adaptations for Independence (HAFI): Enabling Safe and Accessible Living

Jointly sponsored by provincial and federal governments, the Home Adaptations for Independence (HAFI) program is a beacon of support for eligible low-income seniors and disabled homeowners and landlords. This initiative offers financial assistance of up to $20,000 to facilitate modifications that enhance accessibility and safety within their homes.

Tip: If you qualify, explore the possibilities of creating a more comfortable and secure living environment with HAFI.

https://www.bchousing.org/housing-assistance/BC-RAHA

10. BC Seniors’ Home Renovation Tax Credit: Empowering Senior Homeowners

Designed to enhance the lives of eligible seniors aged 65 and above, the BC Seniors’ Home Renovation Tax Credit provides financial relief for eligible permanent home renovations. Aimed at improving accessibility, this program offers a maximum refundable credit of $1,000 per tax year, calculated as 10% of qualifying renovation expenses, up to a maximum of $10,000.

Tip: Take advantage of this tax credit to make your home more accessible and enjoyable.

https://www2.gov.bc.ca/gov/content/taxes/income-taxes/personal/credits/seniors-renovation

11. Mortgage Loan Insurance Premium Refund: Encouraging Energy Efficiency

This program provides home buyers with CMHC mortgage insurance, a 25% premium refund, and potential extended amortization for energy-efficient homes or renovations.

Tip: Explore offers from financial institutions promoting energy-efficient mortgages.

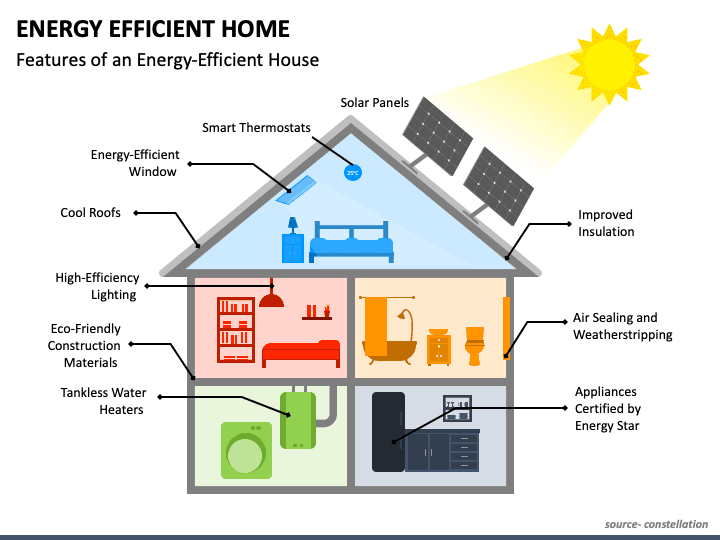

12. Energy Efficiency Programs: Saving Money While Saving the Environment

Various programs, such as the Clean BC Plan, BC Hydro, and FortisBC rebates, offer incentives for making your home energy-efficient. From rebates for high-efficiency heating equipment to energy-saving kits, there’s a range of options to explore.

Tip: Join the Power Smart Team and start a challenge to reduce your electricity use.

The journey to homeownership becomes even more rewarding when you tap into the multitude of government grants and incentives available and can take full advantage. From tax exemptions to renovation credits and accessibility programs, these initiatives are crafted to make your dream home not just a possibility but a comfortable reality. If you have any questions or are looking for more detailed information, be sure to reach out to one of our highly informed realtors who would be happy to guide you in the right direction.